The

insidiousness of fees, taxes, and other

expenses

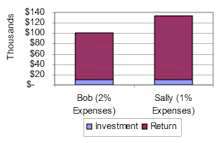

Compare

the impact of fees and taxes compounding

against you:

-

Sally invests

$10,000 in low fee, tax sensitive

index funds and gets a 10% return

over 30 years—with

fees and taxes taking 1%/year.

-

Bob

invests the same

$10,000 and uses stocks and actively

managed mutual funds to get the same

10% over 30 years—with

fees and taxes taking 2%/year.

-

At

the end of 30 years Sally has a

$132,677 and Bob has $100,627,

losing 26% of his return to higher fees and

taxes.

VIA

Note: We have made very conservative

estimates. In the real world, active

management incurs fee and tax expenses

of 3-4% , and over 30 years have a 95%

probability of under-performing an index

funds.

|

Insidiousness of Compounding Expenses

|

|

|

|

|

|